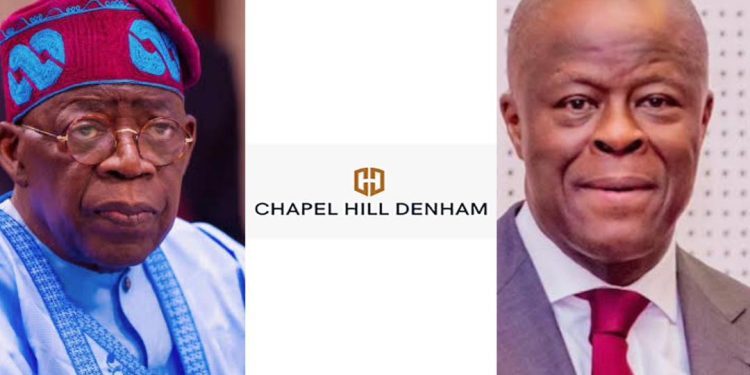

Chapel Hill Denham Group, an investment bank founded by Wale Edun, Minister of Finance and Coordinating Minister of the Economy of Nigeria, has been tapped to advise the Bola Tinubu-led administration to secure a $1 billion Eurobond issuance.

A report by Bloomberg, a UK-based business newspaper, on Thursday said that President Tinubu plans to make the Nigerian economy attractive to investors and has hired Chapel Hill and Standard Chartered Bank to advise his administration on the best strategies to deploy to acquire the billion-dollar Eurobond, which had been paused since 2022 under former president Muhammadu Buhari.

Mr Tinubu, who inherited a declining economy that was heavily indebted from his predecessor, has been finding ways to bolster investors’ confidence to put their money in Nigeria. He has implemented policies such as naira devaluation, naira float, fuel subsidy removal and other reforms at the Central Bank, all of which were intended to entice foreign investors.

In 2022, Chapel Hill Denham became the first domestic lead manager and joint bookrunner to Nigeria’s government, playing a major role in the issuance of a $5.25 billion Eurobond.

It appears the federal government continues to favour the investment bank even after Mr Buhari’s exit from office, particularly because its founder, Mr Edun, holds a ministerial appointment in the incumbent Mr Tinubu’s administration.