The Central Bank of Nigeria (CBN) has reduced the loan-to-deposit ratio (LDR) of deposit money banks from 65 per cent to 50 per cent.

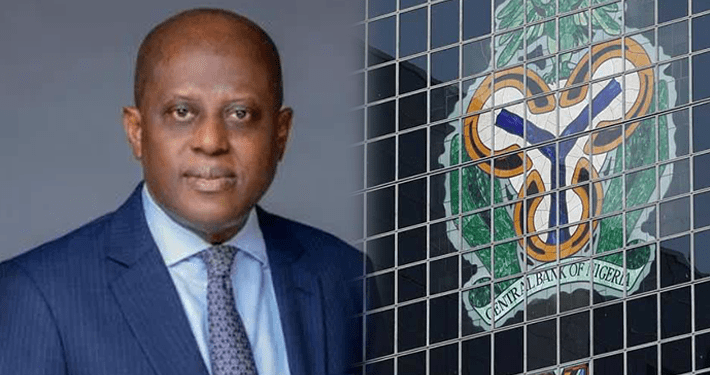

This is according to a letter by Adetona Adedeji, CBN’s acting director of the Banking Supervision Department, addressed to all banks.

Mr Adedeji said that the reduction was in similar proportion to banks’ cash-reserve ratio, which is 45 percent.

He said that the directive was part of measures to deepen monetary policy tightening and improve lending in the real sector of the economy.

“Following a shift in policy stance towards a more contractionary approach, it is imperative to the LDR policy to align with the current monetary tightening of the CBN.

“Accordingly, the CBN has decided to reduce the LDR by 15 percentage points to 50 per cent, in a similar proportion to the increase in the CRR rates for banks.

“All deposit money banks are required to maintain this level and are further advised that average daily figures shall continue to be applied to access compliance,” he said.

He encouraged the deposit money banks to maintain strong risk management practices regarding their lending operations.

Mr Adedeji said that the CBN would continue to monitor compliance, review market developments, and alter the LDR as it deems appropriate.

With the new directive, deposit money banks can now lend 50 per cent of their deposit to their customers.

(NAN)