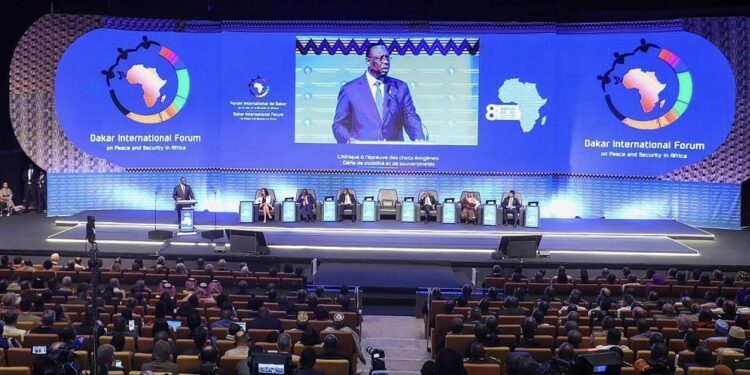

Experts have disclosed that Africa loses about $75 billion annually due to biased credit ratings. They gave the warning at a two-day conference, held on Wednesday in Dakar, Senegal.

The conference was organised by AfriCatalyst, the South African Institute of International Affairs, the United Nations Development Programme, and the African Union Development Agency–NEPAD. It brought together policymakers, economists, and financial experts from across West Africa to discuss how Africa can strengthen its voice within global financial and climate governance, ensuring its priorities shape the agendas of the G20, the fourth International Conference on Financing for Development, and COP30.

The meeting focused on how Africa can achieve fairer access to capital, promote fiscal resilience, and reform international financial systems that have historically disadvantaged developing nations.

A key highlight was the joint presentation by UNDP and AfriCatalyst on the Africa Credit Ratings Initiative, a regional framework designed to reduce the continent’s dependency on external rating agencies that often overstate risk and raise borrowing costs.

According to estimates presented at the summit, Africa loses $74.5 billion annually due to biased ratings, which result in higher interest payments, reduced investment inflows, and limited fiscal space for social services and infrastructure projects.

Catherine Phuong, the UNDP resident representative in Senegal, stated that political commitments must be translated into tangible pipelines, transactions, and measurable outcomes.

According to Ms Phuonh, aligning incentives between policymakers, markets, and think tanks is critical to lowering Africa’s cost of capital.

Bartholomew Armah, chief economist at AUDA-NEPAD, said Africa’s external debt stock reached $863 billion in 2023, equivalent to 169 per cent of total exports.

Mr Armah noted that with average bond yields at 9.8 per cent, debt-service costs now consume 16 per cent of export revenues, draining resources for development.

“Addressing illicit financial flows, which cost the continent an estimated $88 billion annually, and establishing regional financing mechanisms such as the African Monetary Fund and the African Stability Mechanism, are crucial to restoring fiscal stability,” he stated.

Daouda Sembene, chief executive officer of AfriCatalyst, noted that South Africa’s G20 presidency presents a unique opportunity to ensure African concerns are reflected in global economic decisions.

“The voice of the Global South must be heard and prioritised,” Mr Sembene said.

(NAN)