Atthe end of the day, Bitcoin shows no emotion. The cryptocurrency couldn’t care less what crypto bulls and bears have to say or how they feel, about the Winklevoss’s $500,000 target, or that Microstrategy founder, Michael Saylor, added millions in crypto to his company’s balance sheet. When trying to explain big moves in asset prices, we forget that narrative always follows price. Narratives not only simplify the world, but they distract us from the major economic shifts that cause Bitcoin’s price to soar.

The major catalyst behind each of Bitcoin’s historic rallies stares us in the face everytime, yet we overlook it: the health of the fake economy. No matter what narrative people use to explain crypto’s latest rally, the thriving fake economy remains the number one driver of Bitcoin’s booming price. In the past few quarters, as growth and inflation have accelerated, cheap money has supported risk appetite, allowing bullish catalysts to form bullish narratives, enabling crypto to hit the headlines once again. It’s no coincidence that the media thrust Bitcoin into the limelight when the fake economy began to prosper.

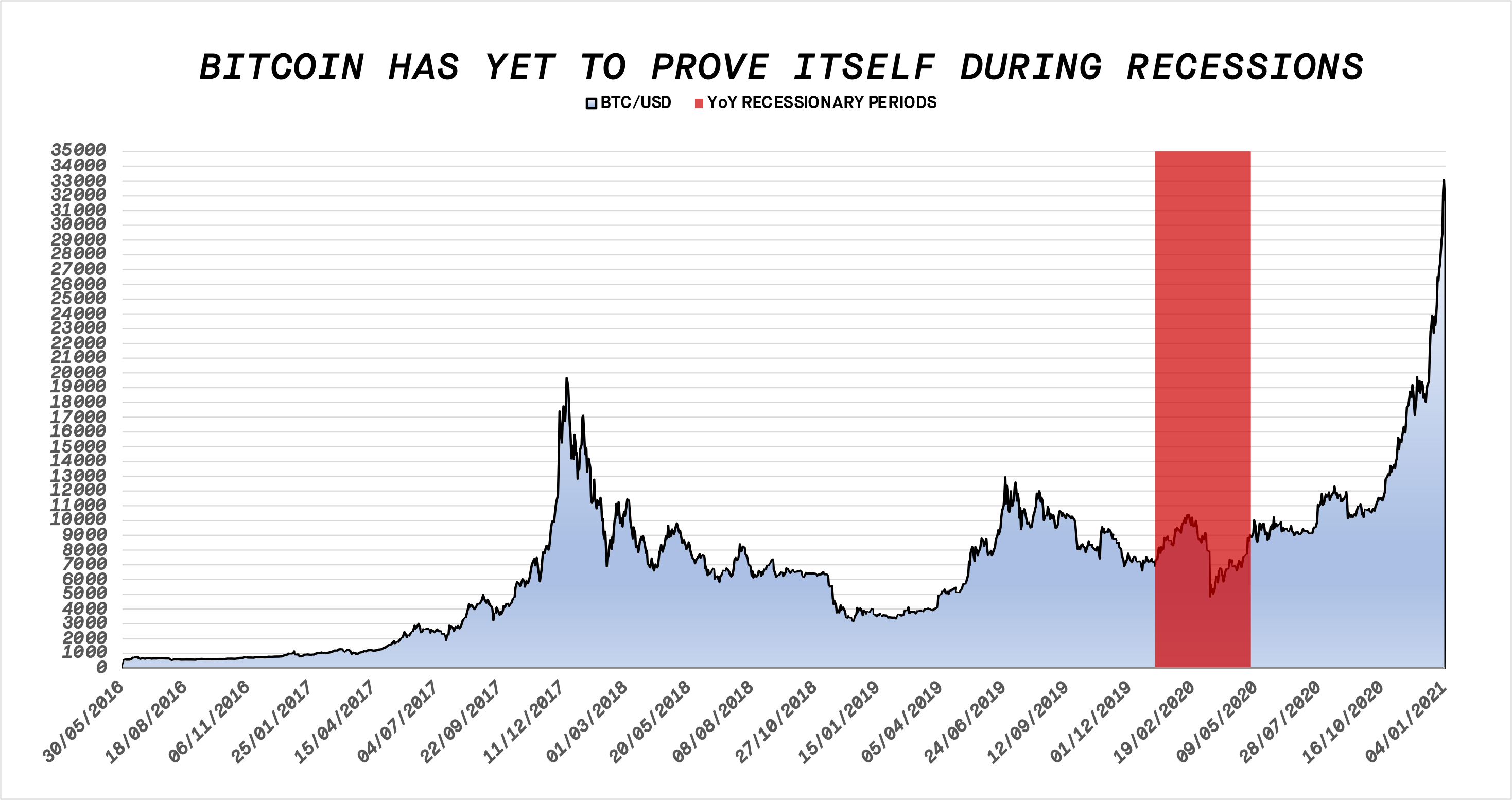

Following the COVID-19 crash, we have also found out that Bitcoin and other cryptocurrencies fail to act as safe-havens. Instead, they remain risk assets, flourishing in booming, mediocre, even stagflationary economic environments. Deflation, however, is crypto’s nemesis. When deflationary forces hit the market, volatility spikes, and crypto becomes the fall guy, providing the worst returns of any asset class.

In Bitcoin’s short history, there have been 33 daily drawdowns of 10% or more in its price ranging from -10% to -39%, with 29 of those 33 drawdowns occurring when economic growth contracted along with inflation, or when the market predicted that both might contract but never did: A deflationary scare. For an example of a deflationary scare, look at how the ISM and consumer confidence peaked temporarily from December 2017 to February 2018. The mainstream narrative, meanwhile, told us Bitcoin was in a bubble, however, no one seemed to realize economic data had peaked, and markets had started to price in deflation — which failed to arrive till later, hence, a scare.

Bitcoin’s past reveals that deflation is crypto’s Achilles heel, and avoiding it allows prices to soar. As long as the elites keep going to any length to support the fake economy, the anger, frustration, and resentment of citizens will keep finding its way into the crypto universe. It’s a monetary paradox.

This also means Bitcoin will continue to outperform its rival gold, though, not for the reasons that Bitcoiners state. Since the gold price peaked while cryptocurrencies hit new highs, Bitcoiners began to reinforce the “crypto is the new gold” narrative. This is a mistake. Gold has underperformed crypto recently only because, for the past 5,000 years, investors have sold the shiny metal when they expected real rates to rise, a behavior investors have yet to acquire when investing in crypto. With Bitcoin, pure euphoria and narrative will fuel its price regardless of real rates, making it the go-to asset to fight against the elite’s financially repressive regime in the near future.

As Bitcoin rises to six figures, however, you have to make a decision: Are you a cult member or are you a rational investor aware of the benefits of holding crypto long-term? If you can’t overcome your emotions and sell before deflation punishes you, you’re guaranteed to suffer big losses.

Crypto, of course, is not invincible. Panic selling and the resulting debt unwind caused by deflation is a force even crypto can’t contend with. If we look at how Bitcoin performs in each economic transition, optimal investing starts with avoiding deflationary transitions and getting out before the market catches on. Staying alert and actively managing your Bitcoin means you avoid periods of crypto Armageddon while magnifying your returns by 1000s of percent. Take if you invested $10,000 in March 2015 and avoided deflationary quarters. You will have returned $2,593,161 (25,831%) compared to $854,464 (8,444%) “HODLing”.

The problem with HODLing — never selling crypto— is we become too religious and too euphoric. On Twitter, all we ever talk about is the price of Bitcoin and how it will eventually go to “the moon”. It will get there eventually, but during the journey, if we keep an eye on the economic data, growing cautious when deflationary signals (growth and inflation indicators reversing, dollar strength, etc.) we will dramatically reduce losses by evading drawdowns similar to the infamous -53.81% crash back in March 2020. Even preventing the average quarterly drawdown by simply monitoring economic indicators remains a no-brainer.

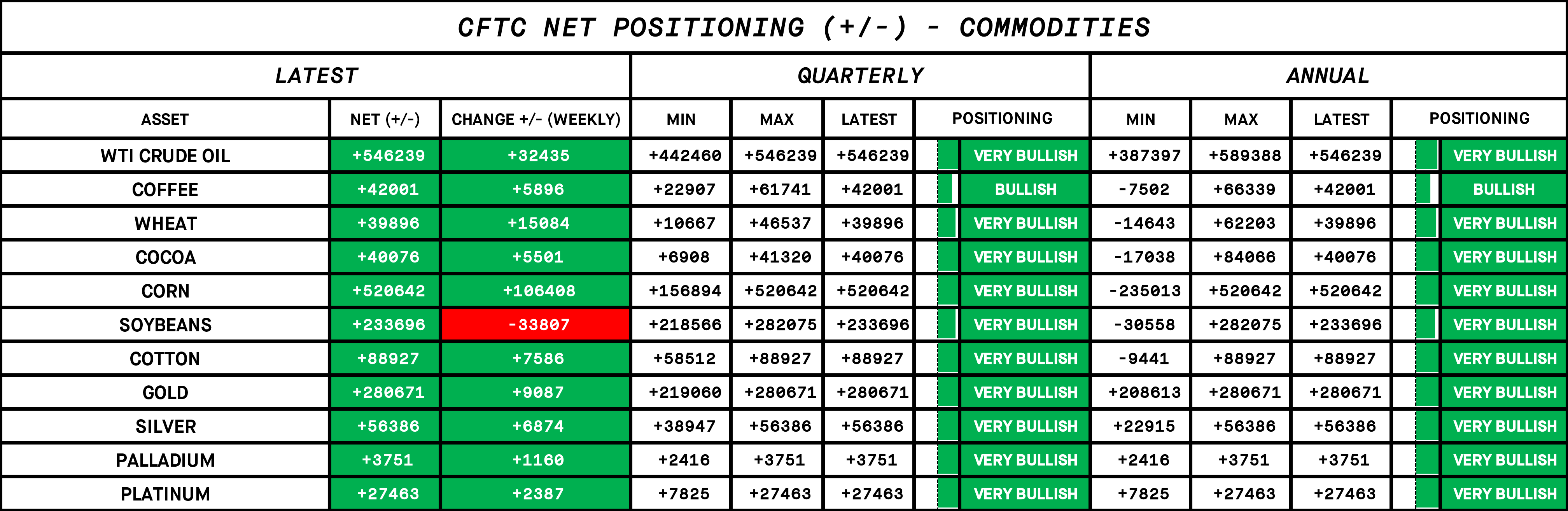

Is all this talk of selling, however, a warning of an impending deflation? No, and definitely not after recent economic indicators have revealed that the fake economy is booming. With the latest ISM numbers coming in hot, reflation will continue, creating the perfect environment for Bitcoin (and almost every non-rate sensitive asset) to deliver big returns in the next quarter or two, at least. The data tells us we’re entering a period where growth, not just inflation, has started to turn positive while the Federal Reserve continues on its greatest money-printing binge in history.

It’s no surprise that Bitcoin had its best quarter on record…

Whatever happens next, we’re about to redefine crazy. It’s paradoxical how the environment in which the elites keep the system stable also supports Bitcoin’s rise. It’s absurd how a real economy — where the economy expands and prices fall — produces the biggest crypto returns. It’s ridiculous that with the U.S. manufacturing industry on the brink of extinction and economic activity at its lowest levels in history, the stock market has reached all-time highs. We’re about to witness the fakest economic boom ever, yet it’s also foolish to bet against it. These crazy scenarios show just how chaotic the economic landscape has become.

In this mad economic environment, there’s no reason Bitcoin can’t reach $100,000, $500,000, even $1 million — which John McAfee surely regrets predicting early. But it will reach these extreme prices, not because of narratives, but because of a healthy fake economy allowing bullish catalysts to form. Catalysts that enable corporations like Microstrategy to become bullish, that empower retail investors to take on debt, load up on crypto, and ride the gravy train to six-figure stardom.

Ultimately, crypto thrives on fakery and hates reality, so the more ludicrous our economy becomes, the higher Bitcoin’s price will soar. No matter how uncertain the next few decades may be, while the financial elites keep perpetrating monetary madness and sustaining the fake economy, Bitcoin — alongside commodities, gold, and “stonks” — will continue to reach new all-time highs, eventually reaching that all-mighty six-figure target all the crypto HOLDers have bet their houses on — they just won’t know the real reason why it finally got there.

SOURCE: MEDIUM