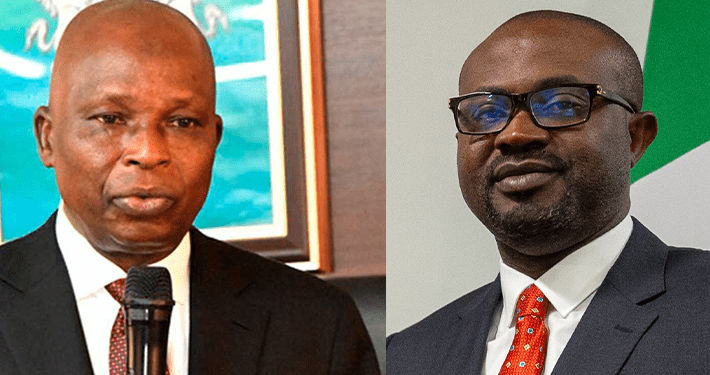

A Federal High Court in Abuja on Thursday ordered the Minister of Interior, Dr Olubunmi Tunji-Ojo, and the Attorney-General of the Federation, Lateef Fagbemi, SAN, to appear before it in three days.

The order is for the interior minister and AGF to show cause why the implementation of the proposed expatriates taxation regime should not be stopped.

Justice Inyang Ekwo, in a ruling on a motion ex-parte moved by counsel who appeared for the plaintiff, Patrick Peter, ordered that the minister and the AGF be served with the motion within three days of the order.

The plaintiff, Incorporated Trustees of New Kosol Welfare Initiative had, in the motion ex-parte marked: FHC/ABJ/CD/1780/2024, sued the interior minister and AGF as 1st and 2nd defendants.

The plaintiff filed the application through a team of lawyers led by Paul Atayi.

The group sought an order of interim injunction restraining the defendants from commencing the implementation of the new Expatriates’ Taxation Regime known as the ‘Expatriate Employment Levy’ in Nigeria, pending the hearing and determination of the motion on notice.

A Programme Implementation Coordinator of the group, Raphael Ezeh, in the affidavit he deposed to, averred that on Tuesday, February 27, 2024, the Federal Government of Nigeria unveiled a set of proposed new taxation policy called the Expatriate Employment Levy.

“According to KPMG and other online information analysts and dissemination agencies, the Federal Government intends to compel companies and organisations who engage the services of foreign expatriates to pay tax E.E.L. as follows:

“For every expatriate on the level of a director — fifteen thousand United States dollars ($15,000.00) equivalent to twenty-three million naira, by the current exchange rates (NW23,000,000.00) per annum. For every expatriate on a non-director level – ten thousand United States dollars ($10,000.00) equivalent to sixteen million naira, by the current exchange rates (N16,000,000.00) per annum,” he said.

Ezeh averred that the Federal Government also planned additional regulations consisting of penalties and sanctions for non-compliance with the proposed taxation regime.

According to him, inaccurate or incomplete reporting will attract five years’ imprisonment and/or N1 million.

He said failure of a corporate entity to file EEL within 30 day is to attract a penalty of N3 million, failure to register an employee within 30 days will also attract N3 million, while submission of false information will attract N3 million.

The coordinator said failure to renew EEL before its expiry date by an organisation is to attract a sanction of N3 million.

Ezeh said, “The proposed taxation regime is totally an anti-people policy because of its radical effect on different aspects of the Nigerian economy and it works like a choke-hold against the economic growth of the nation.”

He said taxation is a sensitive matter which, under the 1999 Constitution (as amended), calls for the collaboration of the executive and legislative arms of government.

He said under Section 59 of the constitution, the executive arm of government alone does not have the powers to impose tax on corporate bodies and other citizens of the nation.

He said the current prevailing tax regime is far friendlier towards expatriates than the proposed one

Ezeh alleged that the minister was about to commence full implementation of the EEL.

“If the defendants are not restrained by an order of this honourable court, they will commence full implementation of the said programme and thereby threatening the nation’s economic sustainability,” he said.

He said the plaintiff undertook to pay damages if the substantive suit turned out to be frivolous.

After listening to Peter, Justice Ekwo ordered the plaintiff to put the defendants on notice of the ex-parte application within three days of the order.

He said, “Upon being served, the defendants are hereby ordered to show cause why the prayers of the plaintiff ought not to be granted on the next date of hearing.”

The judge adjourned the matter until January 16 for the minister and the AGF to show cause.

The federal ministry of interior had, earlier in 2024, suspended the implementation of the EEL launched on February 27, 2024, to allow for further consultations with Nigerian Association of Chambers of Commerce, Industry, Mines, and Agriculture other vital stakeholders.

(NAN)