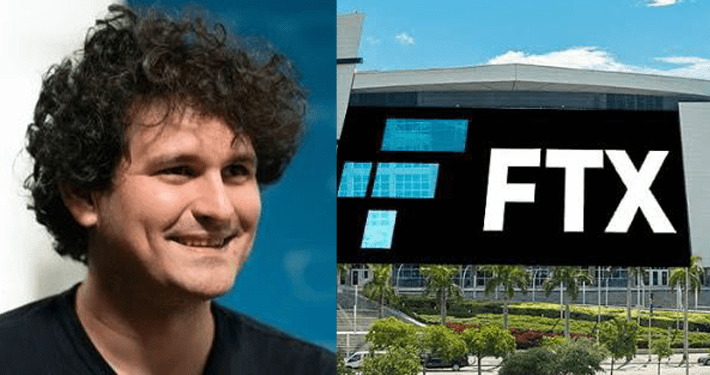

Samuel Bankman-Fried, also known as SBF, 32, of Stanford, California, was sentenced today to 25 years in prison, three years of supervised release, and ordered to pay $11 billion in forfeiture for his orchestration of multiple fraudulent schemes.

Bankman-Fried, who was the founder of the cryptocurrency exchange FTX and the cryptocurrency trading firm Alameda Research, misappropriated billions of dollars of customer funds deposited with FTX, defrauded investors in FTX of more than $1.7 billion, and defrauded lenders to Alameda of more than $1.3 billion.

Bankman-Fried was previously found guilty on two counts of wire fraud, two counts of conspiracy to commit wire fraud, one count of conspiracy to commit securities fraud, one count of conspiracy to commit commodities fraud, and one count of conspiracy to commit money laundering, following a one-month trial before U.S. District Judge Lewis A. Kaplan, who imposed today’s sentence.

“There are serious consequences for defrauding customers and investors,” said Attorney General Merrick B. Garland, “Anyone who believes they can hide their financial crimes behind wealth and power, or behind a shiny new thing they claim no one else is smart enough to understand, should think twice. I am grateful to the U.S. Attorney’s Office for the Southern District of New York and the FBI for their outstanding work in bringing Mr. Bankman-Fried to justice.”

“Samuel Bankman-Fried orchestrated one of the largest financial frauds in history, stealing over $8 billion of his customers’ money,” said U.S. Attorney Damian Williams for the Southern District of New York. “His deliberate and ongoing lies demonstrated a brazen disregard for customers’ expectations and disrespect for the rule of law, all so that he could secretly use his customers’ money to expand his own power and influence. The scale of his crimes is measured not just by the amount of money that was stolen, but by the extraordinary harm caused to victims, who in some cases had their life savings wiped out overnight. As a result of his unprecedented fraud, Bankman-Fried faces 25 years in prison, forfeiture of over a billion dollars, and restitution to his victims. Today’s sentence will prevent the defendant from ever again committing fraud and is an important message to others who might be tempted to engage in financial crimes that justice will be swift, and the consequences will be severe.”

According to the allegations contained in the indictment, the evidence offered at trial, and matters included in public filings: Samuel Bankman-Fried was the founder and chief executive officer of FTX, an international cryptocurrency exchange.

From 2019 to 2022, Bankman-Fried was the leader and mastermind of a scheme to defraud customers of FTX by misappropriating billions of dollars of those customers’ funds.

Bankman-Fried took FTX customer funds for his personal use, to make investments and millions of dollars of political contributions to candidates from both parties, and to repay billions of dollars in loans owed by Alameda Research, a cryptocurrency trading fund that Bankman-Fried also founded.

Bankman-Fried also defrauded lenders to Alameda and equity investors in FTX by providing them false and misleading financial information that concealed his misuse of customer deposits.

Samuel Bankman-Fried repeatedly told his customers, his investors, and the public that customer deposits into FTX were kept safe and were held in custody for the customers, that customer deposits were kept separate from company assets, and that customer deposits would not be used by FTX.

He also repeatedly claimed that his trading company, Alameda, did not have any privileged access to FTX and did not receive special treatment from FTX.

Those statements were false, and Bankman-Fried in fact channeled billions of dollars in customer deposits from FTX to Alameda, and then used those funds to make investments for his own benefit, to make political contributions, and to spend on real estate, among other expenditures. He employed a variety of fraudulent means to perpetrate this fraud.

For instance, Bankman-Fried directed co-conspirators to alter FTX’s computer code to allow Alameda to withdraw effectively unlimited amounts of cryptocurrency from the exchange. Bankman-Fried also made false statements to financial institutions to conceal his misuse of customer dollar deposits.

And he directed the creation of false financial statements for Alameda’s lenders, inflated FTX’s revenues and profits in numbers provided to investors, and backdated contracts and other documents to conceal his fraudulent conduct.

Judge Kaplan authorized the government to use the funds recovered through the forfeiture process to provide compensation to victims of Bankman-Fried’s crimes.

The FBI investigated the case.

The Southern District of New York’s Securities and Commodities Fraud Task Force, with assistance from the office’s Illicit Finance & Money Laundering and Complex Frauds and Cybercrime Units are handling the case.

Assistant U.S. Attorneys Nicolas Roos, Danielle Sassoon, Samuel Raymond, Thane Rehn, and Danielle Kudla are prosecuting the case.