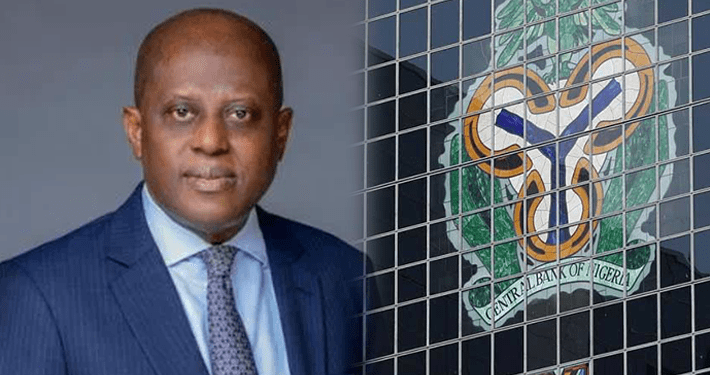

The Central Bank of Nigeria has extended the suspension of processing fees on deposits within some thresholds, according to a statement by Adetona Adedeji, acting director of the Banking Supervision Department, on Wednesday.

The CBN said the suspension of two per cent and three per cent previously charged on cash deposits above N500,000 for individuals and N3 million for corporates had been extended to September 30.

“Consequently, all financial institutions regulated by the CBN should continue to accept all cash deposits from the public without charges until Sept. 30,” it said.

The apex bank initially affected the suspension of charges on cash deposits above those thresholds on December 11, 2023. The extension followed widespread condemnation of the CBN’s recently announced 0.5 per cent cybersecurity levy on electronic transactions.

The apex bank had announced that the levy implementation would start two weeks from May 6. It said the levy should be applied at the point of electronic transfer origination, then deducted and remitted by the financial institution.

“The deducted amount shall be reflected in the customer’s account with the narration, ‘Cybersecurity Levy’,” it said.

However, some 16 banking transactions were exempted from the new cybersecurity levy. They include loan disbursements and repayments, salary payments, intra-account transfers within the same bank or between different banks for the same customer, and intra-bank transfers between customers of the same bank.

With the new levy, N5 will be charged for a transaction of N1,000, while N50 will be charged for a transaction of N10,000. Other charges include N500 for a transaction of N100,000, N5,000 for a transaction of N1,000,000, and N50,000 for a transaction of N10,000,000.

The cybersecurity levy will now be added to the already existing bank charges, such as transfer fees, stamp duty, SMS charges, and VAT. A transaction of N1,000 will incur a charge of N500, while a transaction of N10,000 will incur a charge of N50. Other charges include a charge of N500 for a transaction of N100,000, a charge of N5,000 for a transaction of N1,000,000, and a charge of N50,000 for a transaction of N10,000,000.

The cybersecurity levy will now be added to existing bank charges, such as transfer fees, stamp duty, SMS charges, and VAT.

(NAN)