Russia focuses on other markets, like India and China, with fall in European buyers due to sanctions

ISTANBUL

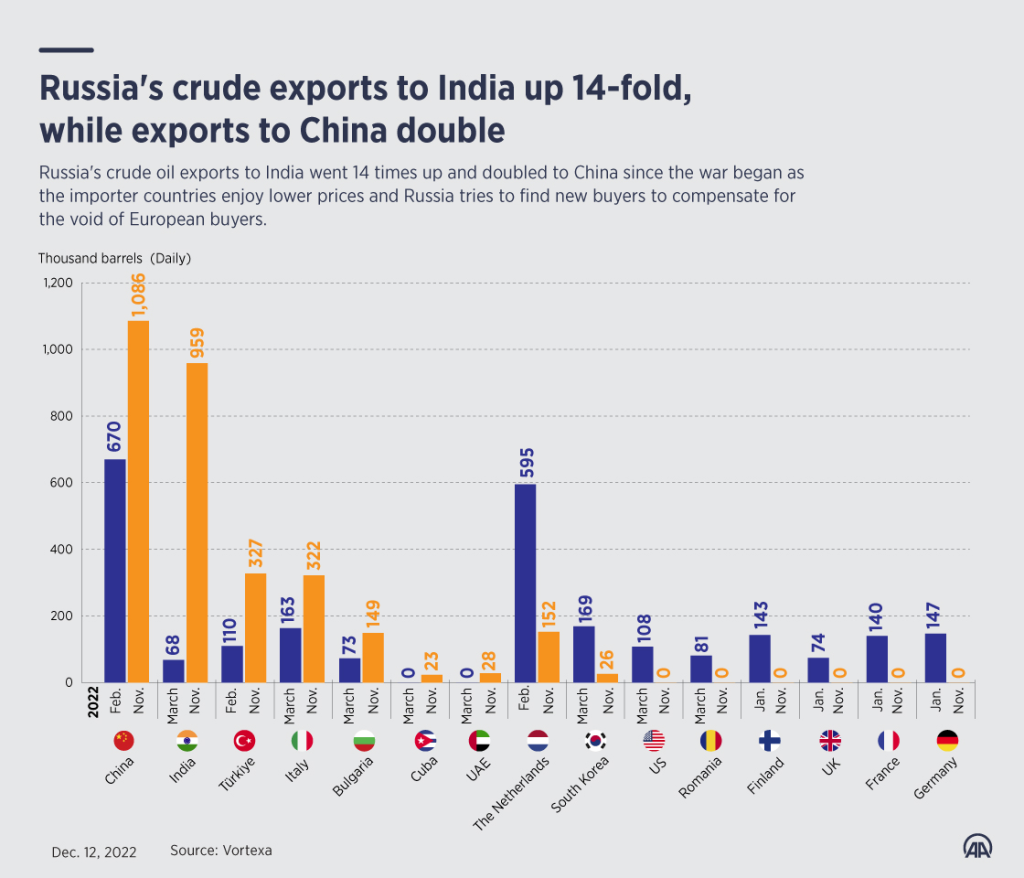

Russia’s crude oil exports to India have increased 14-fold and doubled to China since the start of the Ukraine conflict, with Russia finding new buyers to compensate for the void left by European buyers, according to data compiled by Anadolu Agency from real-time energy cargo tracker Vortexa.

Because of the Russia-Ukraine war that started on Feb. 24, the US and the UK committed to ending crude imports from Russia. The European Union (EU) agreed to impose an embargo on seaborne imports of Russian crude oil beginning Dec. 5, the same day that the EU and G7 agreed to place an oil price cap of $60 per barrel of Russian crude.

The ban on petroleum products will come into effect beginning Feb. 5 next year, corresponding to 90% of Russia’s current oil imports. Bulgaria, however, was excluded from the sanctions until the end of 2024.

With the EU’s move to cut Russian oil exports, Russia has sought customers elsewhere, offering lower prices in a bid to sell its crude.

India has emerged as one of the beneficiaries of the Kremlin’s cheap crude. India’s crude imports from Russia reached their highest volume of 35,000 barrels per day on average in 2021. Despite almost zero imports from Russia in January and February of 2022, India’s Russian crude imports stood at 68,000 barrels per day on average in March 2022.

During the war, India’s seaborne crude exports from Russia increased steadily, reaching 959,000 barrels per day by November 2022, a 14-fold increase.

“Even without joining the G7 price cap, India’s refining sector benefits greatly from the heavily discounted Russian Urals crude oil as there are now fewer buyers left,” TankerTrackers.com said in a Twitter post. The price of Urals was trading at nearly one third less than the Brent benchmark after the price cap.

China, Türkiye, UAE and Cuba increase Russian crude imports

The importance of seaborne crude trade in energy relations between the Kremlin and Beijing has grown.

China’s seaborne crude oil imports from Russia increased from 670,000 barrels per day in February this year to almost double to about 1.1 million barrels per day in November this year.

Türkiye’s crude imports from Russia also almost tripled during the same period, from 110,000 barrels per day to 327,000 barrels per day on average.

Cuba, one of the countries with very limited crude imports from Russia before the war, imported 48,000 and 23,000 barrels per day in October and November, respectively.

The United Arab Emirates joined the discounted Russian crude buyers club by importing about 35,000 barrels per day in May 2022, after almost two years without any Russian crude imports.

The country’s seaborne crude imports from Russia stood at about 28,000 barrels per day in November.

Italy doubles Russian crude imports as Netherlands shows fall

Even before the EU’s sanctions package came into effect last week, a number of European countries almost reset their Russian crude imports to zero.

The exception was Italy, which increased its crude oil imports from Russia from 163,000 barrels per day in February 2022 to 322,000 barrels per day in November 2022. The highest level was 443,000 barrels per day in June 2022. The increase in imports was prompted by Russian company Lukoil’s ISAB refinery in Syracuse, Italy.

The Netherlands, one of the biggest buyers of Russian crude in the EU before the war, also deviated from its European neighbors by continuing to trade, although in lower volumes.

Russian crude exports to the Netherlands dropped to 152,000 barrels per day in November 2022 from their 595,000 barrels per day level in February 2022.

David Wech, a chief economist at Vortexa, told Anadolu Agency that “about 500,000 barrels of Russian oil are currently exported via the northern leg of the Druzhba pipeline to Germany and Poland. Both countries committed originally to stop this imports together with the seaborne imports, albeit Poland has spread some doubt about this recently.”

“If these pipeline exports are really stopped, it means Russia would have to export that crude via seaports, adding to their need to find new buyers,” he noted.

The Druzhba pipeline, also known as the Friendship Pipeline, is the main line carrying oil from eastern European Russia to Ukraine, Belarus, Poland, Hungary, Slovakia, Czechia, Austria and Germany.

A total of 2.5 million barrels of crude oil and 700,000 barrels of petroleum products were transported via the pipeline in October for EU countries.

The sanctions will be temporarily on hold for some landlocked countries, including Hungary, Slovakia and Czechia. These countries will be allowed to import Russian crude oil via the Druzhba pipeline, although they will not be able to sell the oil they buy to other member countries or third parties.